30 Jul, 2020

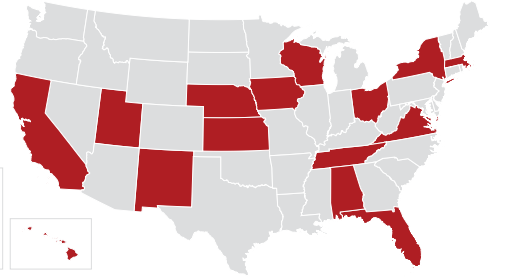

PRESS RELEASE Internal Revenue Service - Criminal Investigation Washington D.C. Field Office Special Agent in Charge Kelly R. Jackson FOR IMMEDIATE RELEASE Thursday, July 17, 2020 Contact: Veronica Kyriakides – (703) 336-4014 The Internal Revenue Service announced its annual "Dirty Dozen" list of tax scams with a special emphasis on aggressive and evolving schemes related to coronavirus tax relief, including Economic Impact Payments. This year, the Dirty Dozen focuses on scams that target taxpayers. The criminals behind these bogus schemes view everyone as potentially easy prey. The IRS urges everyone to be on guard all the time and look out for others in their lives. "Tax scams tend to rise during tax season or during times of crisis, and scam artists are using pandemic to try stealing money and information from honest taxpayers,” said IRS Commissioner Chuck Rettig. “The IRS provides the Dirty Dozen list to help raise awareness about common scams that fraudsters use to target people. We urge people to watch out for these scams. The IRS is doing its part to protect Americans. We will relentlessly pursue criminals trying to steal your money or sensitive personal financial information." Taxpayers are encouraged to review the list in a special section on IRS.gov and be on the lookout for these scams throughout the year. Taxpayers should also remember that they are legally responsible for what is on their tax return even if it is prepared by someone else. Consumers can help protect themselves by choosing a reputable tax preparer. The IRS urges taxpayers to refrain from engaging potential scammers online or on the phone. The IRS plans to unveil a similar list of enforcement and compliance priorities this year as well. “Americans are already experiencing so many challenges; the last thing taxpayers need is to be victimized by one of these scams,” said IRS-CI Special Agent in Charge Kelly R. Jackson. “We are hoping that by raising the public’s awareness to these tax scams, less people will fall prey.” An upcoming series of press releases will emphasize the illegal schemes and techniques businesses and individuals use to avoid paying their lawful tax liability. Topics will include such scams as abusive micro captives and fraudulent conservation easements. Here are this year's ‘Dirty Dozen’ scams: Phishing: Taxpayers should be alert to potential fake emails or websites looking to steal personal information. IRS Criminal Investigation has seen a tremendous increase in phishing schemes utilizing emails, letters, texts and links. These phishing schemes are using keywords such as "coronavirus," "COVID-19" and "Stimulus" in various ways. Fake Charities: Criminals frequently exploit natural disasters such as the current COVID-19 pandemic by setting up fake charities to steal from well-intentioned people trying to help in times of need. Fake charity scams generally rise during times like these. Threatening Impersonator Phone Calls: IRS impersonation scams come in many forms. A common one remains bogus threatening phone calls from a criminal claiming to be with the IRS. The scammer attempts to instill fear and urgency in the potential victim. In fact, the IRS will never threaten a taxpayer or surprise him or her with a demand for immediate payment. Social Media Scams: Taxpayers need to protect themselves against social media scams, which frequently use events like COVID-19 to try tricking people. Social media enables anyone to share information with anyone else on the Internet. Scammers use that information as ammunition for a wide variety of scams. These include emails where scammers impersonate someone’s family, friends or co-workers. EIP or Refund Theft: The IRS has made great strides against refund fraud and theft in recent years, but they remain an ongoing threat. Criminals this year also turned their attention to stealing Economic Impact Payments as provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Senior Fraud: Senior citizens and those who care about them need to be on alert for tax scams targeting older Americans. The IRS recognizes the pervasiveness of fraud targeting older Americans along with the Department of Justice and FBI, the Federal Trade Commission, the Consumer Financial Protection Bureau (CFPB), among others. Seniors are more likely to be targeted and victimized by scammers than other segments of society. Scams targeting non-English speakers: IRS impersonators and other scammers also target groups with limited English proficiency. These scams are often threatening in nature. Some scams also target those potentially receiving an Economic Impact Payment and request personal or financial information from the taxpayer. Phone scams pose a major threat to people with limited access to information, including individuals not entirely comfortable with the English language. Unscrupulous Return Preparers: Selecting the right return preparer is important. They are entrusted with a taxpayer's sensitive personal data. Most tax professionals provide honest, high-quality service, but dishonest preparers pop up every filing season committing fraud, harming innocent taxpayers or talking taxpayers into doing illegal things they regret later. Offer in Compromise Mills: Taxpayers need to wary of misleading tax debt resolution companies that can exaggerate chances to settle tax debts for “pennies on the dollar” through an Offer in Compromise (OIC). These offers are available for taxpayers who meet very specific criteria under law to qualify for reducing their tax bill. But unscrupulous companies oversell the program to unqualified candidates so they can collect a hefty fee from taxpayers already struggling with debt. Fake Payments with Repayment Demands: Criminals are always finding new ways to trick taxpayers into believing their scam including putting a bogus refund into the taxpayer's actual bank account. The IRS will never demand payment by a specific method. Payroll and HR Scams: Tax professionals, employers and taxpayers need to be on guard against phishing designed to steal Form W-2s and other tax information. These are Business Email Compromise (BEC) or Business Email Spoofing (BES). This is particularly true with many businesses closed and their employees working from home due to COVID-19. Ransomware: This is a growing cybercrime. Ransomware is malware targeting human and technical weaknesses to infect a potential victim's computer, network or server. Malware is a form of invasive software that is often frequently inadvertently downloaded by the user. Once downloaded, it tracks keystrokes and other computer activity. Once infected, ransomware looks for and locks critical or sensitive data with its own encryption. In some cases, entire computer networks can be adversely impacted. Visit www.IRS.gov/newsroom for additional information on these scams and the latest news releases from IRS.